Businesses are increasingly using the digital business card app

This is a digital age where technology has revolutionized almost every aspect of our lives, including how we network and exchange our contact information. Gone are the days when we carried around packs of traditional paper business cards. Now people have a better alternative - they have embraced a digital business card app to flawlessly manage their networking efforts. In this blog, we will explore the multiple benefits of using a digital business cards app to understand what values it offers. Now let’s dive deeper and explore the power of a digital business card app.

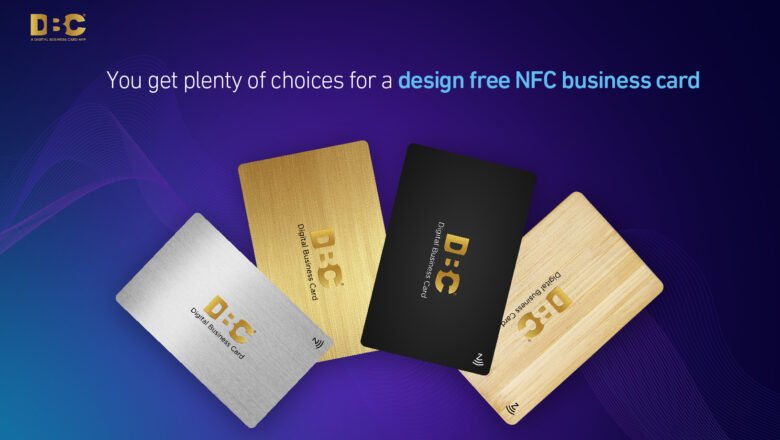

What is a Digital Business Card App?

Before appreciating the benefits of using a digital business card app, let us first understand what it is. Digital business card apps are a type of mobile applications ...